5 Things Your CPA Should Tell You

How Preparing for your Tax Returns Can Set You and Your Business Up for Success in the Long Run

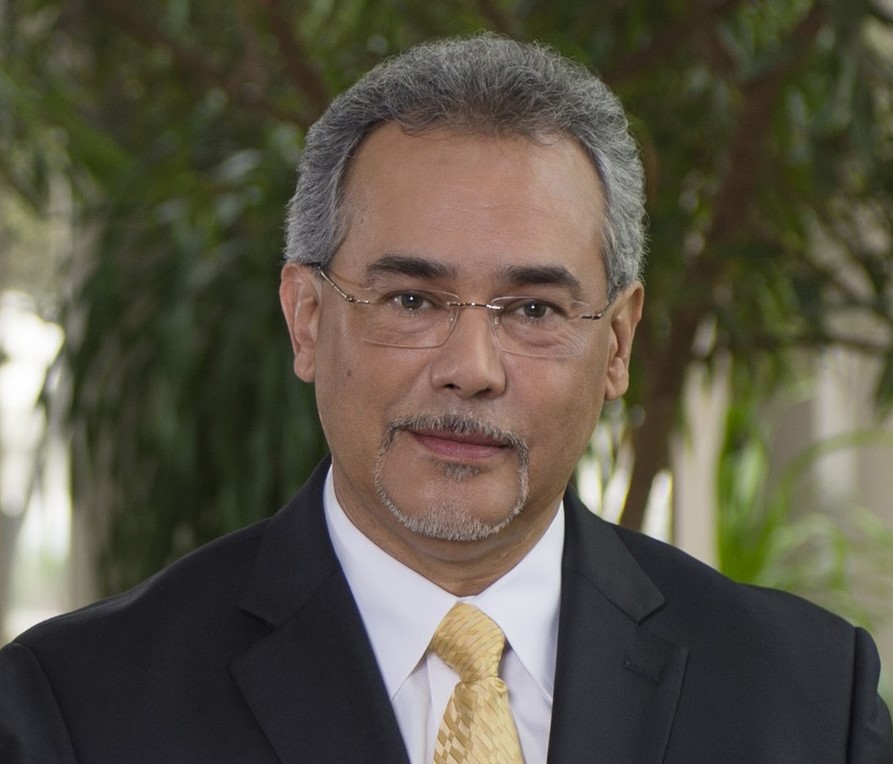

By Jim Rice , CPA

Having been a CPA for more than 40 years, I have had the opportunity to work with many different clients in numerous situations. While no two are alike, I want to share a few thoughts that I believe are important and applicable to anyone working with a CPA:

1. You truly get what you pay for.

Great advisors are always busy and typically more expensive but worth it. Give your CPA time to understand a situation and provide advice. Don’t be overly concerned to avoid professional fees because that often results in a large financial detriment.

Make sure to work with a CPA who has experience working with your particular industry as there are advantages to having a thorough understanding of the tax law nuances as they apply to different types of business industries and structures.

I often get the question, “What can I deduct?” This conversation should be about your financial goals and how the tax laws can assist in getting you there. The more your CPA knows about you and your financial goals, the more help he or she is to you.

2. Learn to understand your tax returns.

While I don’t mean for you to become an accountant, it is important that you have an understanding of how different types of income are taxed and how your taxes were determined. Also, if you receive financial statements, you should feel comfortable reading and understanding what they tell you about your financial situation.

Ask your CPA to sit down and explain your financial statements and tax returns if you have any questions. The more questions you ask us, the better a CPA can be of service to you. Even before a CPA can be of help, a great bookkeeper should be keeping the books up to date and accurate.

3. Embrace complexity as needed.

Proactive tax planning can have a significant impact on your bottom line. A CPA can’t help you plan for income taxes after the ink has dried on a contract. Keep your CPA up to date on your activity to ensure that they can offer you meaningful planning advice on how to structure significant transactions.

Review your will after the enactment of every major tax law and after every major change in your life. As your estate grows, look more closely at asset protection tools like a family limited partnership, limited liability company and trusts. Wrap valuable assets like business properties in separate limited liability companies.

If you have employees or you are an employee, have employment agreements that are clear and cover all aspects of employment. If you are an owner with others,establish company agreements that can settle issues like exit disagreements and sale of the business.

4. Having internal controls within your business can save your assets.

Hiring the right people for the right job is highly important. Simple procedures like performing background checks and fully vetting the competency of new hires can help save your business’ assets and reputation.

Pay top dollar for everyone who takes care of you. Internal financial controls are crucial to help protect yourself by deterring employee theft and other related crimes.

Fraud is often committed by the most trusted employees, which can include family. Never give the sameperson check-writing and bank reconciliation responsibilities.

5. Keep an eye on the future for yourself and for future generations.

If you have not adequately addressed what you need to retire comfortably, it is never too late or too soon to develop a plan.

This is where a certified financial planner is so important. Retirement plans like a company 401(k) or individual retirement accounts can be great. Some retirement plans allow larger contributions. Investigate these. But if your retirement account is very large and you may not need to use all the funds, then creative planning can help you avoid future taxes on that account.

Services such as estate planning, business succession planning, and family tax planning can go a long way to protecting your assets.

Educate future generations on how you make your money. Address the tax implications of your income and plan for the future.

Managing your money and your taxes is challenging work. But after four-plus decades as a CPA, I can tell you that embracing these five steps will produce much more optimal results for you and your family.

Jim Rice, CPA, is a shareholder at Sol Schwartz & Associates and works with numerous San Antonio-area families, professionals, and business owners on a wide range of complex tax and accounting matters.

He may be reached at jprice@ssacpa.com or 210.384.8000